If you have been following various finance forums or hanging out with friends, you might have been told to top up your Supplementary Retirement Scheme (SRS) account to lock in your retirement age. However what exactly is an SRS account and what does it mean to 'lock-in' your retirement age. In this article, you will understand more about SRS and the potential benefit you can gain from it

What is the Supplementary Retirement Scheme (SRS)?

SRS is a voluntary saving scheme for individuals to save for their retirement in addition to their CPF. While doing so, you would be eligible for tax relief equivalent to the amount saved to your SRS account. As such the more you contribute, the more you save on tax*.

If you are a Singaporeans, you can contribute up to $15,300 yearly while foreigners can contribute up to $35,700 yearly to their SRS

Unlike CPF, you can withdraw your money from your SRS account anytime. However, you may not want to do so as early withdrawal will be subjected to a 5% penalty on the sum withdrawn. Besides, 100% of the sum withdrawn will be taxed.

*There is a personal income tax relief cap of $80,000 for all tax reliefs claimed. As such, do evaluate whether you would benefit from your SRS contributions before going ahead.

Source: DBS

So how much could you potentially save from the tax relief?

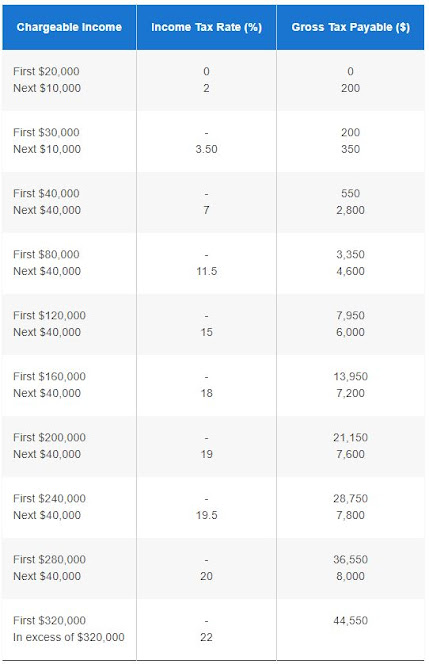

Notice there is a big jump in tax rate when your income crosses above $40,000? That is the point where you can consider contributing to your SRS to maximize your tax relief.

To give you an example, if you have earned $40,000 last year, you would have paid $550 in income tax this year.

Fast forward to this year, you got a promotion and now earn $50,000. When the time comes to pay your income tax, you would be paying $550 (first $40,000) + $700 (next $10,000) = $1250. This is definitely a significant increase.

However, if you were to deposit your pay increment of $10,000 into your SRS, you will be given a dollar for dollar tax relief of $10,000. As such only the first $40,000 of your salary is chargeable and your income tax drops back down to $550. Saving you $700.

You can use DBS's SRS calculator to calculate how much tax savings you can enjoy.

(Tax relief will be automatically applied to your tax based on the information provided by the SRS operator as such you do not have to do anything to make a claim)

SRS withdrawal

Investing with your SRS monies

Should I use SRS or CPF Retirement Sum Top-Up?

Both SRS and CPF RSTU allows you to save more for your retirement while benefiting from the tax relief. However, that is where the similarities end. Here are some of the differences between both.

SRS can be withdrawn anytime

While there is a penalty fee when it comes to withdrawing from your SRS account, the flexibility of your SRS account provides you a certain amount of liquidity in the event you require your money urgently. On the other hand, you will not be able to access your CPF funds at all.

Yearly contribution cap

SRS has a higher yearly contribution cap of $15,300 for Singaporeans. On the other hand, the CPF RSTU has a contribution cap of $7,000. (Another $7,000 if you include contributions to your family members)

Interest rate

SRS provides a base interest rate of 0.05% while CPF has a minimum guaranteed interest rate of 4%. Of course, you can invest with your SRS money and potentially achieve a higher interest rate. However, this is not guaranteed as compared to CPF.

Why should you open your SRS account now?

Opening an SRS account

- Log in to your ibanking account (DBS/UOB/OCBC)

- Apply for Supplementary Retirement Scheme

- Top up at least $1 to your SRS

Note: You can only have 1 SRS account at any point in time. As there are not a lot of difference in terms of what the 3 banks offer, you should consider just opening with the bank which you frequently use.

Do look out for promotions by respective banks. From time to time there will be promotions like cash gifts or vouchers if you open an SRS account with them.

Opinion

This assumes you do not have other taxable income like rental income.

Comments

Post a Comment