With the recent rise of Roboadvisor, should you start putting money into them? StashAway is the first Roboadvisor I ever used since the start of my investing journey. I started around April 2019 with S$50 in the account when I still new to investing. As of today, I have close to S$4500 in it and I am planning to continue contributing to it

As such I would like to share my reviews on it for you to decide if StashAway is worth a try.

Who is StashAway

StashAway is an investing platform that helps builds personalized asset allocation according to your specific needs and preferences and helps you invest in those assets to accumulate wealth over time.

Currently, StashAway offers 3 investment products for both retail and accredited investors. All of them do not have a minimum deposit requirement and provide zero withdrawal fees. Meaning you can start as low as S$1.

1) General or Goal-based Investing portfolio (USD denominated ETFs)

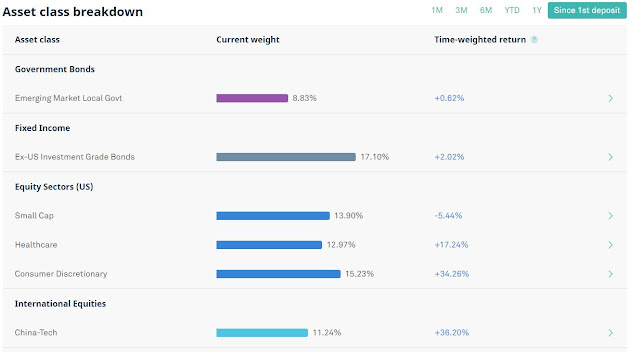

This is StashAway's main investment product. It is a globally diversified portfolio of ETF which consists a mixture of government bonds, equities, and commodities. Some holdings in the portfolio include KraneShares CSI China Internet ETF, Vanguard Total International Bond ETF, Consumer Discretionary Select Sector SPDR Fund, SPDR Gold Trust, and much more. (Pretty diversified)

Your portfolio allocation would be based on the risk index you have chosen and is split into 2 main portfolios. A core portfolio with a risk index between 6.5% to 22%, and a higher risk portfolio with a risk index between 26% to 36%. During your account setup, StashAway would provide you a recommended risk index. You can choose to follow or adjust to your comfort level. Do note that higher risk does not always equate to higher returns.

You can take a look at how different portfolio have performed below

If you want to accumulate your wealth over the long term or for a particular goal, you can consider this option.

2) Income portfolio (SGD denominated ETFs)

The Income portfolio comprises of 6 SGX-listed ETFs that represent a mix of SGD-denominated government bonds, agency bonds, investment-grade corporate bonds, REITs, and dividend-focused equities. Currently, these are the Straits Times Index, SG Government Bond, SGD Investment Grade Corp Bond, S-REIT, Asia ex-Japan REIT, and Asia High Yield Corporate Bonds.

The purpose of this portfolio is to provide regular income payout which can be sent to your personal bank account or be further reinvested to compound the growth.

3) Simple portfolio (SGD Cash management portfolio)

StashAway Simple portfolio is a Singapore Dollar cash management portfolio for investors looking for a temporary place to park their funds.

Other then the expense ratio that the Unit Trust managers charge, there are no management fees for this portfolio. This portfolio provides a rate of 1.4% p.a. return

Pricing

Compared to its peers, in my opinion, StashAway fee is slightly higher. Its annual management fee is calculated as a percentage of the total assets under management which ranges from 0.2% - 0.8% and is charged monthly on a pro-rata basis. Refer to the table for the breakdown of the cost.

Is StashAway safe

StashAway AKA Asia Wealth Platform currently holds a Capital Market Services License for Fund Management issued by MAS. With this license, it means that StashAway meets the capital, compliance, audit, and reporting requirements from MAS.

Additionally, your funds are in a separate custodian account and not mixed with StashAway's operational funds. As such, in the case of bankruptcy, our funds will still be safe.

My current investment in StashAway

How to sign up

If you are interested to invest with StashAway, consider using my referral link. You will get up to S$10,000 of your assets managed for free for 6 months

- Click on the link which will bring you to StashAway's website

- Set up your account

- Choose your desired portfolio and risk index

- Fund your account within 30 days

h674h7maire746 dual stimulator,horse dildo,realistic vibrators,horse dildo,realistic vibrators,dildos,sex dolls,vibrators,horse dildo z773g9rdqzy341

ReplyDelete