Budgeting can be a hassle. However, it is important to do it if you want to take control of your finances.

While some may prefer using excel sheets to track their finances as it provides them the most customizability, there are quite a few budgeting apps out there which you could consider trying. I have shortlisted 3 of them which I feel you can start with.

The best budget apps

- Seedly

- Money Manager

- YNAB

Seedly Expense Tracker (Basic)

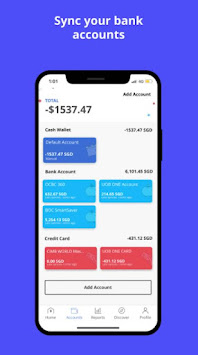

As the name suggests, the Seedly Expense Tracker is built by the Seedly team for the general public to use at no cost. Seedly Expense Tracker is relatively easy to use compared to other budgeting apps available in the market though with limited functionally. However, if you are starting out as a beginner, it definitely offers the necessary functions of a budgeting app for you to track your finances.

Some of its functions include:

- Bank syncing

- Tracking of day to day transactions

- Setting of budgets

- Monthly reports and breakdown of your expenses and income

- Total Wealth

MoneyManager (Intermediate)

Next up is MoneyManager by RealByte. This apps offers all the functions I have mentioned for the seedly expense tracker less bank syncing. It allows you to track day to day transactions, setting of budget, provide monthly reports, and show your total assets.

To add on, MoneyManager provides much more customizations to your budgeting app so that it fits your lifestyle. I have listed some of them below.

- The setting of regular payments

- Customizable categories and subcategories

- Customizable monthly start date (If your payday is on the 10th, you can start your month on the 10th)

- Carryover settings (Allow your previous month's outstanding balance to be reflected on Total for this month. If you overspend the previous month, the app would nudge you the spend lesser this month to compensate for the overspending.)

Cons

While MoneyManager offers a free version, you can only have a maximum of 10 accounts. (Accounts meaning different 'wallets' like Cash, DBS bank, Loans, etc). If you want to set up more than 10 accounts, you would have to folk out a one-time payment of $5.99. I would say try out the free one first, if you ever need more than 10 accounts along the way, then you can consider upgrading.

MoneyManager does have a web version though it is not the prettiest and not the best in terms of user experience.

Of course with more customizations, the app is definitely a bit harder to get used to compared to the Seedly Expense tracker. However, once you get the hang of it, it would be very easy to use.

YNAB (Advance)

YNAB is different from other budgeting apps. It requires you to be forward-looking and intentional about where every dollar goes to. Every month when you receive your income, you need to make a plan for every dollar you have earned. So for example my salary is S$3500, I have to decide where I am going to use my money. ($2000 for saving/investment, $200 for household expenditure, $500 for parents, and so on)

The app essentially follows 4 simple rules. Give Every Dollar a Job, Embrace Your True Expenses, Roll With The Punches, and Age Your Money. You can follow this link if you want to learn more about the rules.

Benefits

Two of the features that make YNAB stands out from the rest are firstly its forward-looking budgeting and secondly, it allows the sharing of finances with your partner so you both can work towards a goal together.

Below are some features of this budgeting tool include:

- Forward-looking budgeting

- Bank Syncing (Only for US and Canadian Banks)

- Real-Time Updates across devices

- Goal Tracking

- Reports on progress

- Personal support and teaching, 7 days a week

- Budgeting with your partner

- Great UI across all their devices (Web, iPhone, Android, iPad, Apple Watch and Alexa)

Cons

While this app can do wonders for you, it is quite complicated and it will take a while before you get the hang of it.

Additionally, YNAB is not free. It comes at a cost of $84 per annual or $11.99 per month after a 34-day free trial.

Great news for students. YNAB is offering to college students a 12 months free period usage (in addition to the free 34-day trial). If you are interested, write to student@ynab.com with proof of enrollment - a student ID card, transcript, or tuition statement. Anything that can prove you are currently enrolled and includes your name, your school, and the date will do.

I have merely scratched the surface of YNAB, head over to their website to learn more.

Verdict

Personally, I really like YNAB however as a student I feel it is overkill. So for now I will just stick with Money Manager which satisfies all my needs But if you are a working adult, do give YNAB a try and see if it works for you.

Comments

Post a Comment